Fairfield News

Fairfield News in Your Inbox

Questions for Us?

Contact our Public Relations Team

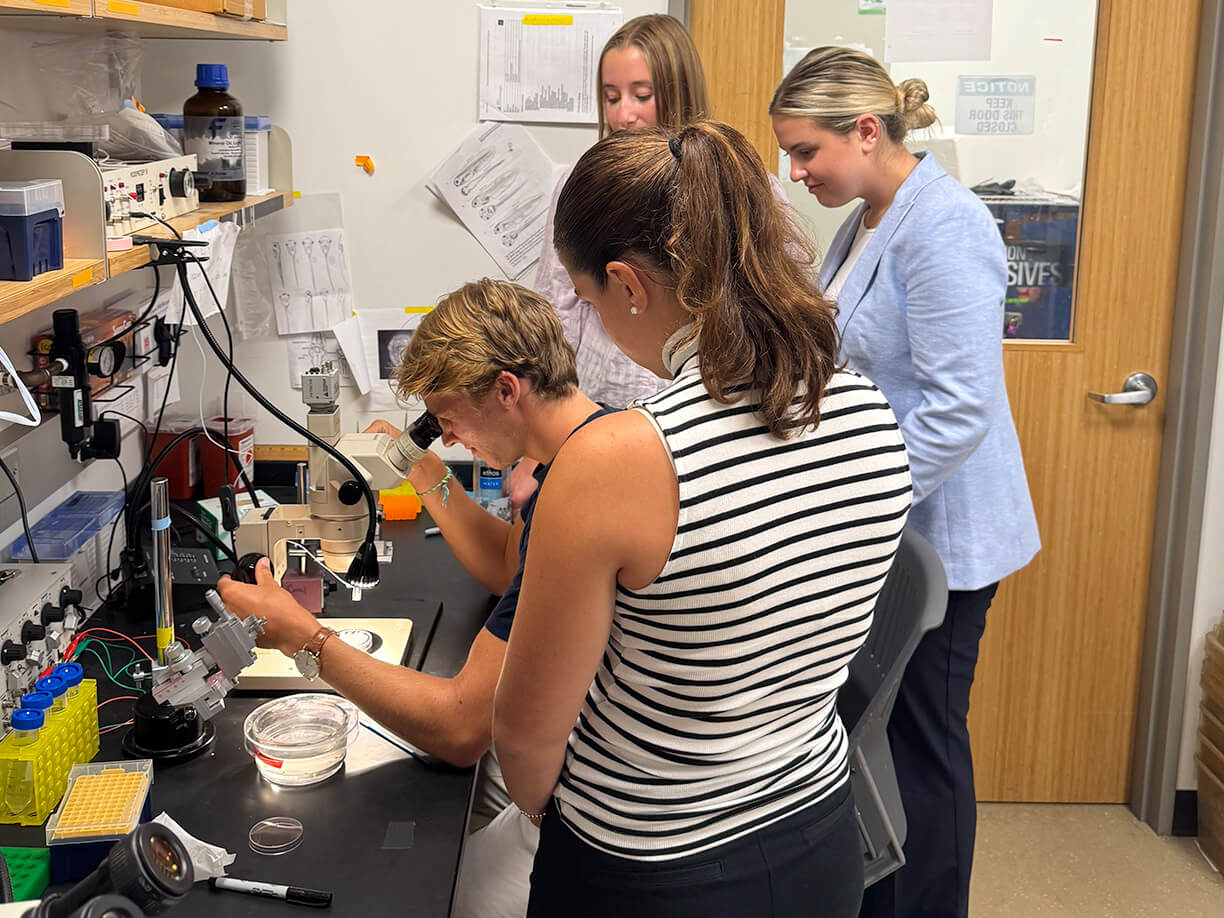

Assistant Professor Elizabeth Stone, PhD, the Ed O'Connell Professor in Chemistry, traveled this past summer to Washington, D.C., with her student research team: Eleanor Feuster ’27, Kacey McGorry ’27, Mason Macuch ’28, and Katelyn Wiehe ’27, to meet with Georgetown University collaborators in the He Lab, Department of Biology.

I went straight into Covid out of college. I more or less had to learn to leverage social media because all contact with prospective clients was now virtual. I had to learn on the fly.”

Contact our Public Relations Team